Closing Costs

Closing Costs are the typical expenses a buyer or seller pays upon the completion of their real estate purchase or sale. These costs vary depending on several factors, including location, property type, and the price tag of the listing.

Identifying Closing Costs, you have to pay for your transaction will help you budget correctly for your upfront payment. Our blog post offers a helpful guide to buyers and sellers looking to get additional information regarding Closing Costs for their real estate transaction.

Should you have additional questions regarding Closing Costs or would like to work with a local realtor for your home buying or selling needs, please feel free to Contact Our Team today.

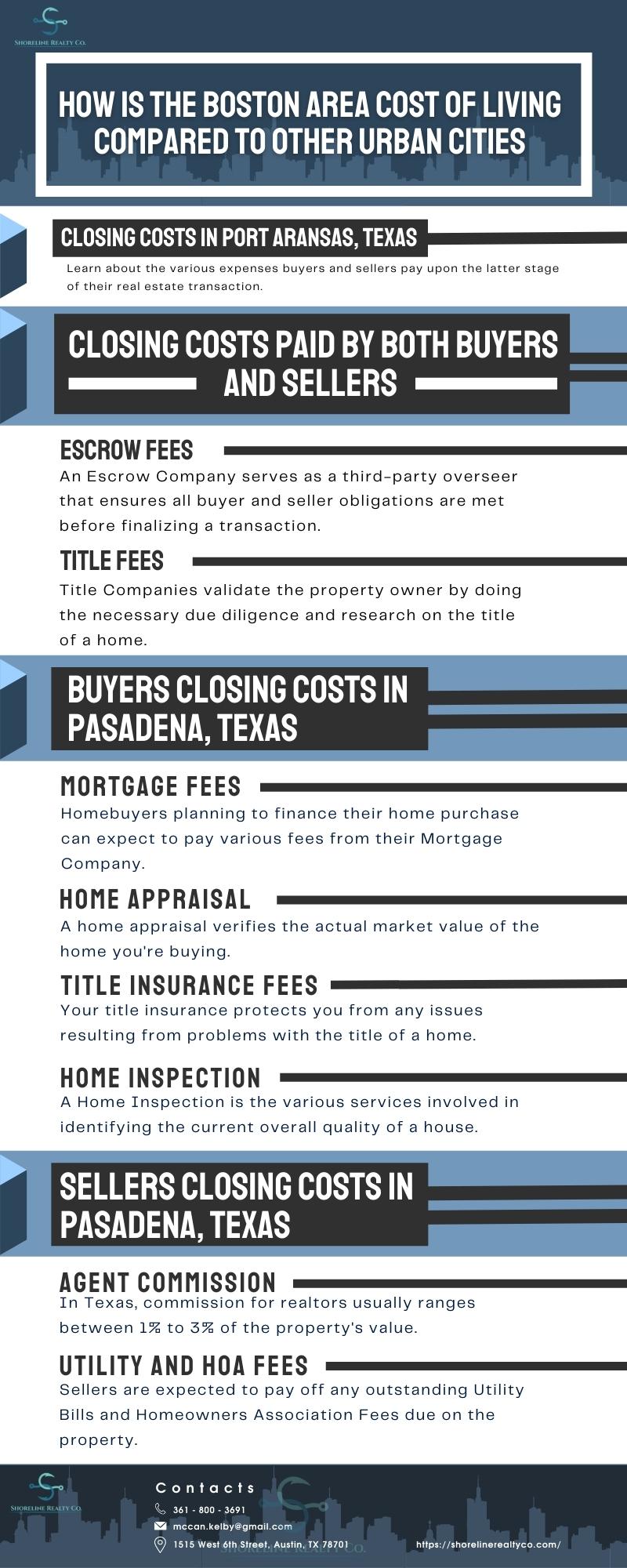

Closing Costs in Port Aransas, Texas

Closing Costs are paid by buyers, sellers, or both parties. You’ll want to make sure you know which costs you are expected to pay. Although these costs have traditional designations on who pays them, you should keep in mind that all of them are open for negotiation. You’ll want to consult with your realtor on the best way to get a good deal for your particular situation.

Closing Costs Paid by Both Buyers and Sellers

Escrow Fees

Escrow Fees are the various costs that you pay your Escrow Company. An Escrow Company serves as a third-party overseer that ensures all buyer and seller obligations are met before finalizing a transaction.

If you’re a buyer, you’ll have the Escrow Company hold on to your deposit payment. This serves as proof to the seller that you have the capacity to make the purchase and ensures they don’t have access to the deposit funds until the transfer of ownership can be processed. If you’re the seller and Escrow Company, ensure that your home is not transferred to the buyer without payment funds available for disbursement.

The typical Escrow Fee in Texas is around $350.

Title Fees

Title Companies validate the property owner by doing the necessary due diligence and research on the title of a home. If you’re a seller, you want to employ the services of a Title Company to provide proof that you are the actual owner of a property and have the authority to sell the home.

If you’re a buyer, you want to have your own Title Company do the necessary research to ensure you can buy the house. Working with a Title Company helps prevent possible fraud, counterclaims, hidden liens on the property, and other potential problems that may arise from purchasing a home.

The typical cost you can expect to spend from Title Fees ranges between 0.6% to 0.9% of the property’s value.

Attorneys Fees

It is highly recommended for you to have your own lawyer when purchasing or selling a home. Having a lawyer you can trust to protect your interests will ensure that you are fully informed of the various terms indicated in your sales contract.

In Texas, it is not required for a lawyer to go over the paperwork of your deal. However, if you opt to hire a lawyer to review them, you’ll probably have to pay around $350 to $600.

Buyers Closing Costs in Pasadena, Texas

Mortgage Fees

Homebuyers planning to finance their home purchase can expect to pay various fees from their Mortgage Company. You’ll want to spend enough time getting quotes from different lenders available in your area. Getting multiple offers will help get you the best deal possible.

Always ask for a Good Faith Estimate whenever you talk to a lender. A GFE is an itemized breakdown of the various expenses included in your home loan and will allow you to compare different offers much more effectively. You’ll also be able to negotiate some fees that you think can be removed from the quote from your lender.

Home Appraisal and Insurance Fees

Buyers planning to get a home loan will be required by their lender to get a home appraisal. Your home appraisal confirms a property’s current market value, which ensures that the loan you are getting is within reason. Title Insurance Fees will protect both the buyer and lending company from any possible issues resulting from the title of a property. Home Appraisals in Texas usually range between $320 to $425.

Home Inspection

An essential Closing Cost that buyers want to ensure is done before finalizing a home purchase. A Home Inspection is the various services involved in identifying the current overall quality of a house. Checks you’ll want include structural and foundation inspections, roof, termite, sewage, plumbing, electrical, and more.

A typical home inspection in Texas will set you back around $350 to $600, depending on the size of the house.

Sellers Closing Costs in Pasadena, Texas

Agent Commission

Realtors representing both the buyer and seller typically get their commission from the sale of the home. Traditionally, the seller pays the realtors for both parties. In Texas, commission for realtors usually ranges between 1% to 3% of the property’s value.

Utility Bills

When selling a home, you’ll want to pay off all outstanding bills on the property before transferring ownership. In most cases, statements are prorated depending on the number of days before the deal is closed.

In instances where you want the profits from the sale of the home to pay for outstanding bills, you want to communicate that correctly with the buyer so they can work with you to pay off these Utility Bills promptly.

Homeowners Association Fees

Similar to Utility Bills, sellers are expected to pay off any outstanding HOA Fees that may be due on the property. You’ll also want to notify your HOA on time if you’re proceeding with the sale of your home.